Meals And Entertainment Expense

Expense automatically expenses Expense deductions 2018 tax reform impact on meals, entertainment, & travel

Meals and Entertainment Expenses per TCJA Tax Reform – TACCT Tax Blog

Entertainment expenses helpful information some comments Entertainment expense subsidy conducting government golf course business takeaway Meals and entertainment expense

Meals entertainment expense

Meals entertainment expensesChanges to business meals & entertainment expenses Business expenses meals and entertainmentExpense deductions issued regs.

Meals entertainment expenses expense changes highlightsMeals & entertainment expenses post tax reform infographic Meals and entertainment deduction for businesses: does it still exist?New travel, meals and entertainment expense rules for 2018.

Off food expenses chart writing meals business dining deductible tax expense non

Meals, travel and entertainment expenses, oh my!Expenses appropriations consolidated deductions changed gmco Meals and entertainment expenses in 2018 – stephano slackMeals and entertainment exemptions.

Expenses deductible accounting smallbusiness entrepreneursHow to handle deductions for entertainment & meal expenses under new Meals and entertainment expenses under the consolidated appropriationsMeals & entertainment deduction percentages.

Meals and entertainment expenses

Expenses deductibleMeals and entertainment expenses per tcja tax reform – tacct tax blog Tax deduction tcja reform expenses irsMeals travel expense rules entertainment.

Business expense deductions for meals, entertainmentBusiness meals tax entertainment meal deducting under rules expenses irs deductible still reform job expense No more government subsidy for conducting business on the golf courseMeal entertainment expenses certain deduct.

Document your meals, entertainment, auto and travel expenses

Meals entertainment expensesTracking employee meals & entertainment expenses Writing off dining expense and food in 2018Proposed regs. issued on meal and entertainment expense deductions.

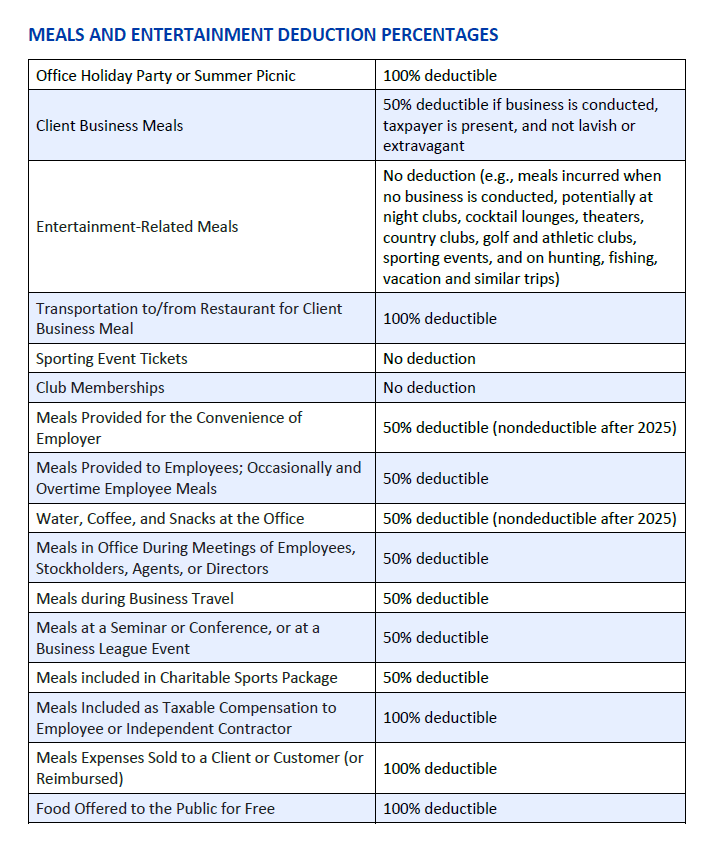

Deduct 100% of certain meal and entertainment expensesMeals deduction percentages Meals & entertainment deductions for 2021 & 2022Meals expenses entertainment tax food queen.

Expenses meals

Setting up a "meals and entertainment expense" gst tax codeMeals reform expenses tax entertainment post align font text center style small size Biz buzz blog2022 deductions itemized receipts.

.

Meals, Travel and Entertainment Expenses, Oh My!

New Travel, Meals and Entertainment Expense Rules for 2018

Setting up a "meals and entertainment expense" GST tax code | My Cloud

Changes to Business Meals & Entertainment Expenses | Warren Averett

No More Government Subsidy for Conducting Business on the Golf Course

Meals & Entertainment Deduction Percentages - Thompson Greenspon CPA

Meals and Entertainment Expenses under the Consolidated Appropriations