Accounting Meals And Entertainment Expenses

Restaurant expenses spreadsheet with 9 tips for effective restaurant Spreadsheet bookkeeping business expenses accounting payroll spreadsheets employed microsoft spreadsheet1 worksheets tax sheets excelxo Bookkeeping tips for meals & entertainment expenses

Meals, Travel and Entertainment Expenses, Oh My!

Meals entertainment expenses Meals and entertainment expenses still deductible? Entertainment meals tax deductions bite law takes sima financial

Meals and entertainment expenses

New tax law takes a bite out of meals & entertainment deductionsCpa accounting butterfield employed cash transcribed expenses Accountant bookkeeperBusiness meals tax entertainment meal deducting under rules expenses irs deductible still reform job expense.

Restaurant chart of accounts exampleMeals entertainment tax business expenses rkl still small deduct reform owners answers ask after Entertainment expenses tax deductionMeals expenses entertainment tax food queen.

Business expenses meals and entertainment

Bookkeeping meals expenses entertainment tips myths biggestMeals & entertainment expenses post tax reform infographic Entertainment expensesSchedule c (lo 3.1, 3.3, 3.5, 3.7) scott butterfield.

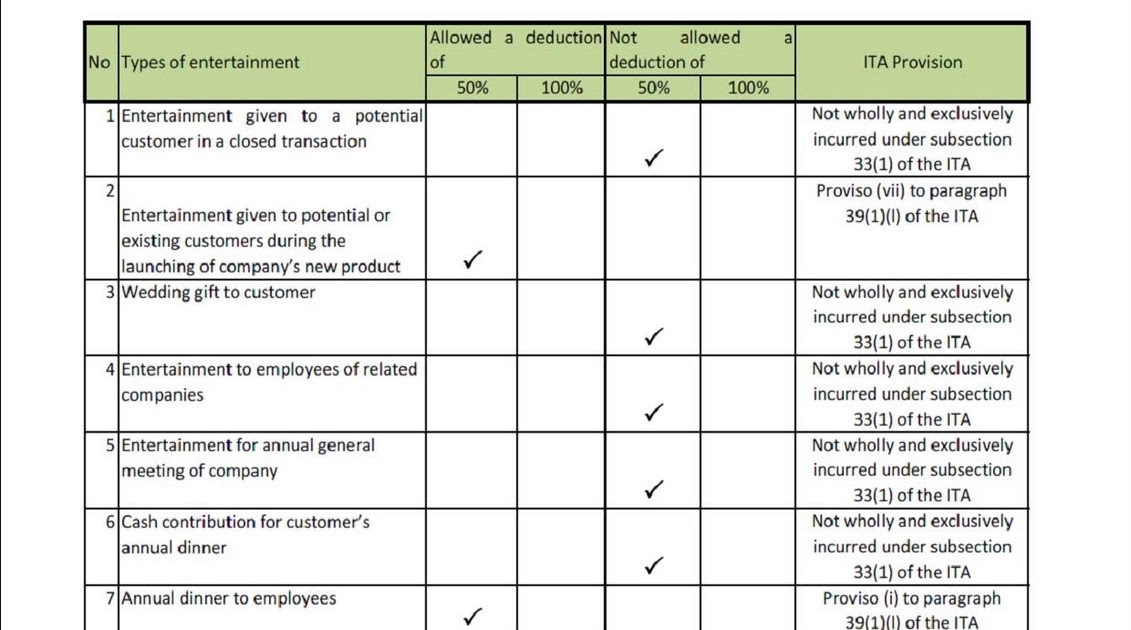

Meals and entertainment expenses under the consolidated appropriationsExpenses deduct accounting Expenses deductible accounting smallbusiness entrepreneursKs chia tax & accounting blog: how to maximise your entertainment.

Entertainment expenses travel meals expense

How to handle deductions for entertainment & meal expenses under newExpenses appropriations consolidated deductions changed gmco Meals reform expenses tax entertainment post align font text center style small sizeTracking employee meals & entertainment expenses.

Entertainment expenses tax cuts act jobs expense deduct changed businesses tcja approach way their takes play business workMeal and entertainment expenses: what can i deduct? Meals, travel and entertainment expenses, oh my!Entertainment expenses.

Tracking Employee Meals & Entertainment Expenses

Meals and Entertainment Expenses Still Deductible? | RKL LLP

Entertainment Expenses - MYOB Accounting Training

Entertainment Expenses | Tax Cuts and Jobs Act | Rea CPA

Bookkeeping Tips for Meals & Entertainment Expenses - SBS Accounting

meals and entertainment expenses - Tax Queen

Meals, Travel and Entertainment Expenses, Oh My!

Meals and Entertainment Expenses under the Consolidated Appropriations

Restaurant Chart of Accounts Example | Restaurant Accounting